Or

By clicking Sign In, Join Free or Continue with Facebook, Linkedin, Twitter, Google, I agree to the Terms & Conditions and the Privacy Policy

Or

By clicking Sign In, Join Free or Continue with Facebook, Linkedin, Twitter, Google, I agree to the Terms & Conditions and the Privacy Policy

November 19, 2021

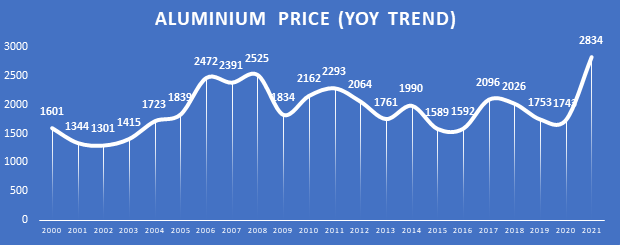

November 19, 2021The global aluminum benchmark price has been on a rising spree post- pandemic, exceeding US$3,000 per tonne in October 2021, the highest since July 2008. Since the last 20 years, that was only the second time the global aluminium price rose to such a high level, attributable to tight production and supply amid robust demand and coup in Guinea.

PRICE TREND OF ALUMINIUM

Around mid-October 2021, the global aluminium benchmark price on the London Metal Exchange (LME) touched US$3000 a tonne. Compared to the previous year, aluminium price in 2021 grew by over 50 per cent. In the last 10 years, the global aluminium price never breached US$2,500 per tonne and mostly hovered between US $1700-2000/tonne. Post the pandemic in 2021, aluminium price began increasing due to sharp fluctuations in the economic activity during the pandemic and huge supply-demand mismatch. China also played a key role in this.

RISING DEMAND

Economic recovery, supported by stimulus packages in various countries, helped increase the demand for various metals, including aluminium. Analysts said economic activity increased significantly in Asia, the biggest consuming region of aluminium , led by China's increasing appetite. Europe and the United States' economies were also on a recovery path to maintain growth with the help of supportive policies. Across the globe, aluminium usage grew from 86.9 million tonnes in 2020 to 93.5 million tonnes in 2021.

The aggregate demand rose impressively through 2021, but many end-use sectors were yet to fully recover from the 2020 setback. While the packaging industry performed well, driven by beverage cans and pharma packaging, automobile production was behind the pre-covid levels. However, overall a sharp focus on greener economy cushioned the demand growth in the global aluminium industry.

SUPPLY ISSUES

There was a prominent mismatch in demand and supply of aluminium in the post pandemic world. While most of the supply routes were inactive due to the COVID-19, demand suddenly spiked, resulting in a 33 per cent decline in LME-registered warehouses to 1.3 million tonnes and 42 per cent slump in SHFE stocks to 228,529 tonnes. (Reuters)

Coup in Guinea (the world’s second largest producer of bauxite ore) caused a lot of ripples and uncertainties in the bauxite supply in 2021, leading to production disruption of the primary metal and price hike.

ROLE OF CHINA

China is one country that commands more than 50% market share in both production and consumption of aluminium. In 2021, China's internal policy decision, shift towards a greener economy, and climate issues affected the aluminium price. Disruption in hydropower supply in Yunnan (which alone has 10% of China’s total aluminium capacity) province due to draught also affected the production and consequently the price. China’s efforts to reduce carbon footprint were also an area of concern for aluminium producers as majority of them were dependent on dedicated coal-fired plants for electricity supply.

On the other hand, China’s demand was seen continuing to be strong, particularly on the heels of growth in electric vehicles production and increased offtake of aluminium in cars. That's why China's import of aluminium was high in 2021, and the country was competing with other nations for supplies, causing hikes in prices.